In less than a decade, cash went from the undisputed king of payments to being almost extinct. Increasingly, the use of cash has been slowing with the rise of contactless payment systems, the popularity of mobile technology, and the development of Open Banking.

However, the change from predominantly cash-based transactions to an almost cashless society didn’t happen overnight. As technology develops ways to make financial transactions faster, safer, and more manageable, cash is gradually being replaced by alternative forms of payment.

The introduction of cheques, credit cards, and debit cards was the first step toward replacing cash, and now these payment methods have become mainstream. Fast-forward to today’s world – contactless payments, integrated app-based payments, and digital wallets are available to meet the growing consumer expectations.

Taking the pulse of cash transactions

Despite its decline, in 2019, cash still accounted for 30.2% of global POS transactions, right above debit cards, which represented 24.3%, according to FIS. But the impact of the pandemic was colossal and, as in-store commerce started to shift to eCommerce, cash now accounts for only 20.5% of the global point of sale transactions, according to the same source.

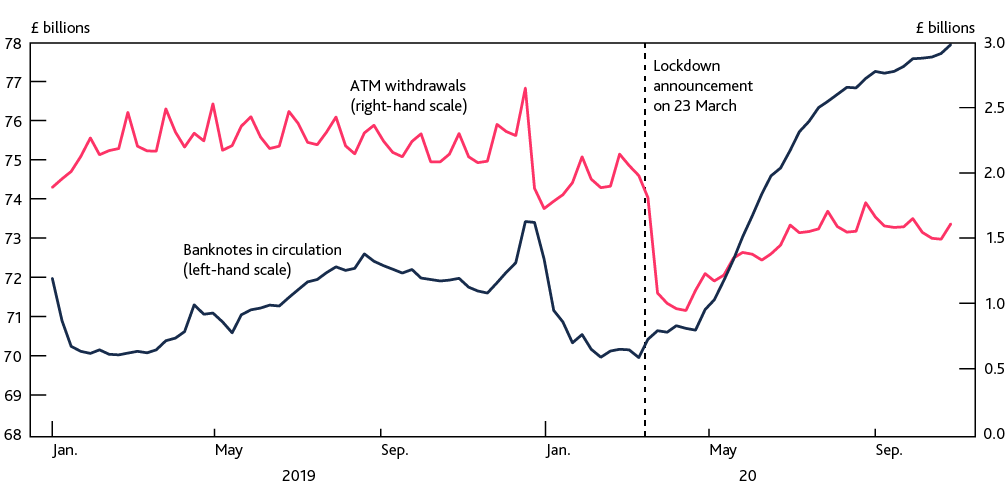

The statistics look grim for the future of cash transactions. Even though the Bank of England claims that, in the UK, there are 70 billion pounds worth of notes in circulation (the equivalent of £1,000 per person), during Covid-19 a strange phenomenon has been happening: cash use declined, but the demand for banknotes increased.

Sources: Bank of England and LINK ATM Network

Throughout the United Kingdom, a lot of cash is held in banknotes to pay for things: cash in our wallets; cash at the till; and cash at the ATM. But during the pandemic, many people have held on to cash as savings.

The overall global outlook tells us a different story. While cash use in countries in Europe, specifically Germany, Italy, Spain and Poland, is expected to remain above average, cash now accounts for 11.4% of transactions in the US. With cards remaining the top payment option, FIS predicts continued gains for mobile wallets in this part of the world. At the other extreme are the Middle East and Africa, where cash accounts for 52.6% of all transactions and Latin America, where cash is 38% of the share of POS transactions. In the Asia-Pacific, the use of cash is at 19.2%, with cash being the preferred payment method in Indonesia, Japan, The Philippines and Vietnam.

The benefits of cash

There are many benefits of using cash, including anonymity, stability, and acceptance almost anywhere. The truth is that nothing is as universal, foolproof, and anonymous as cash although most countries’ current regulations require various declarations for large purchases in cash. The use of cash, more than anything, comes down to cultural preferences. For example, in , cash is popular for a few reasons. First, its ageing population is not keen on making the jump to digital payment methods. Second, for Japanese culture, cash inspires both trust and convenience. Similarly, when it comes to trust, Germany is very conservative, thus very cash-heavy. And once individual preferences are embedded, it takes a long time to change them.

Also, cash can be used to perform economic actions such as buying, selling, or paying debt, as well as meeting immediate wants and needs. From natural disasters to economic downfalls, cash is the backup in emergencies. Cash is still the safety net when travelling internationally, as cards are still not accepted everywhere. And lastly, it makes consumers more aware of their spending habits and budgeting.

But is cash still holding its spot for the future?

Apart from geography and age, significant factors that determine how consumers choose to pay are lifestyle, spending habits, and financial attitudes. Therefore, a cashless society may one day arrive, but not in the foreseeable future. Even though the pandemic created a tipping point, there is still an essential need for cash, wherever it is used. And cash is used every day by consumers at their own discretion.

However, the sunset of cash looms on the horizon in those economies that are more immersed in digital technologies. A digital, cashless future is dawning in China, as well as in Sweden. In the rest of the world, a cashless future is not about the complete eradication of cash but about specific verticals adopting a cashless approach, the closest being retail, hospitality and sports entertainment.