Perhaps you’ve heard of open banking before but weren’t really sure what it is or what it could mean for you. Open banking is a relatively new financial service (it’s been around in the UK since 2018) that connects banks, third parties, and technical providers, allowing them to initiate [payments and share data quickly and securely to the benefit of their customers.

In practical terms, let’s say you are using your mobile phone to control all your financial transactions. Open banking would be the service that allows you to bundle them all in one platform or application, alongside managing your consent to give other companies access to your financial information.

How Open Banking works?

The description above sounds simple enough, but you might be wondering exactly how open-banking works and what sort of information is shared with a third party. You might also have concerns about data protection (GDPR) and the risks of sharing your financial information. Fret not – we have the answers to these questions.

First and foremost, let’s be clear about one thing – you don’t have to share your financial data if you don’t want to. Banks must allow information sharing, but only if you give permission to a new provider as they cannot just look into your accounts as they please.

When you sign up with a provider, you will be asked for permission to access your information. After that, your bank will process the request and share the relevant information you opted-in for. At any time, you can withdraw your permission to share your information.

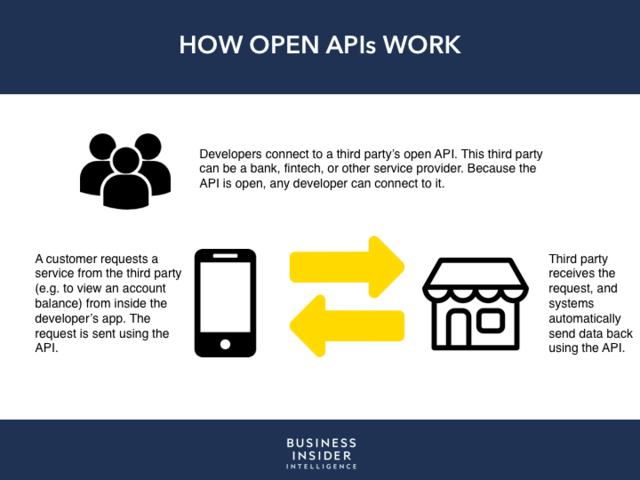

Enabling the flow of information are APIs (Application Programming Interfaces) – these are what open banking depends on to communicate information. In simple terms, they are connections between computer programs that allow information to be exchanged. APIs make it possible for third-party providers to receive instructions from banks in order to access consumer data if they give permission.

Source: Business Insider

Sharing your data

It is important to remember that you are best protected against fraud only if you share your data with an authorised company. You can tell if a company is authorised to use open banking by checking if they’re regulated by the Financial Conduct Authority (FCA) in the UK and is listed on their directory or a European Regulator and listed on the Open Banking Register.

There are usually three types of services an authorised company can offer:

Account Information

An authorised company will allow you to see your account information from multiple banks in one place. The type of information shared is the account holder’s name, account type, the date the account was opened, transaction information, etc.

Payment Services

This enables you to pay suppliers directly from your bank account without having to enter all the payment details and without going through Visa or Mastercard card services.

Product Data

This refers to the types of products and services a financial institution like a bank can offer. It can potentially help with offering budgeting features and price comparison.

The Benefits of Open Banking

Open Banking can potentially revolutionise how you manage your money, being beneficial to both consumers and businesses. Let’s take a look at some of the benefits it brings:

Onboarding

Using open banking, companies can verify account ownership with your bank without outsourcing or requiring you to upload documents manually.

Business payment solutions

Businesses have access to payment products that improve cash flow, lower costs, increase visibility, and reduce fraud. Moreover, making payments with open banking is faster than manually setting up a transfer, so businesses can make their payment processes efficient and frictionless.

Seeing the big picture

By using Open Banking, you can access all your accounts from one place instead of logging into multiple accounts in your web browser or switching between multiple apps on your phone. Making essential purchase decisions is easier with an overview of your finances, as you can analyse the funds coming in and going out of your accounts and help you better identify problem areas and opportunities.

Easier loans

A lack of credit history can prevent you from getting favourable borrowing terms. However, Open Banking-based services allow lenders to access historical bank account data to determine your credit score.

Should you use Open Banking?

Banking with open systems is a matter of personal choice, and if you are uncomfortable managing your finances through third-party apps, open banking might not be for you. But if you’re interested in a unified way of managing your finances and being more in control of them, open banking can be a viable option. Online and in-store purchases will increasing offer this payment method and some banks will also report on all of your accounts.

Did you enjoy this article? Then, you may also find our guide on cryptocurrency payments helpful.