We are nearing the day when real-time payments will become the norm for all businesses. The gaming industry is no stranger to this mentality shift as customers continue to focus on the speed of payments, for example, expecting their winnings to be sent in real-time. Moreover, 70% of them prefer this to happen directly via their direct debit card.

Though the global pandemic was a catalyst for faster disbursements, the road to real-time was built long before. In 2017 to be more specific, at a time when Visa launched Visa Direct, a platform that leverages real-time technology to allow players to collect funds instantaneously and gambling companies to offer an unparalleled experience to their customers. The platform can process P2P (person to person) payments, B2C (business to consumer) and B2B (business to business) payments.

In four years, Visa Direct now reaches 3 billion consumers in 200+ countries and over 160 currencies. And since, in the last year alone, online gaming Ofcom reports a boost in online gaming by a whopping 62%, the leading gaming companies have jumped on this wagon and started offering payouts to cards.

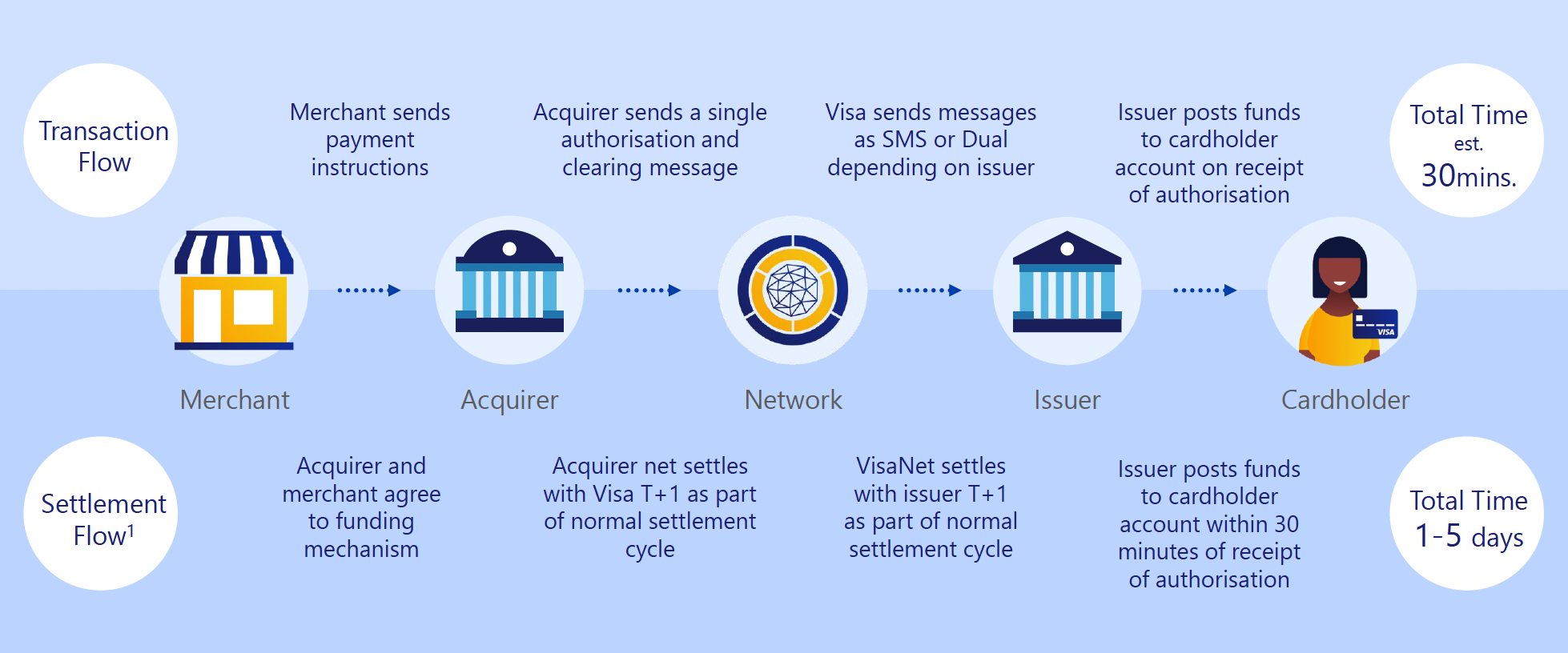

Before Visa Direct, customers had to wait 3 to 5 days to access their funds; now, they can see their money in their accounts within 30 minutes. Here is how the new transaction flow works with TrustPayments’ payment gateway.

● The merchant sends the payment instructions to TRU Connect.

● TRU Connect sends a single authorisation and a clearing message to Visa.

● Visa sends messages as SMS or Dual depending on the issuer, and the issuer posts funds to the cardholder account on receipt of authorisation.

Payout speed matters and is an important decision factor for consumers. A known fact in gaming is that more than half of the online gamers use multiple websites, and players who receive quick payouts are happy customers who will keep coming back again and again.

4 Main Benefits of Visa Direct

1. Near-instant global payments

With this service, you can pay in real-time using debit or prepaid cards. Funds are available within 30 minutes. Moreover, it simplifies cross-border and multi-currency payment arrangements by giving users access to a single point of contact, saving time, cutting costs and enhancing the user experience. The service also reaches 99% of banked consumers in the world.

2. A frictionless payment experience

Visa Direct offers a simple digital experience without requiring bank or routing numbers. It is available 24 hours /7 days a week/365 days per year while also being aligned with your customers’ preferences, such as receiving payments directly in their debit account.

3. Flexible and easy to scale

The platform’s flexibility allows it to grow or shrink in sync with your company, handling payments at scale while also supporting a range of industry-standard formats.

4. Secure

Visa’s robust security systems provide reassurance to anyone using Visa Direct, with the most stringent risk and compliance controls in place across an established and trusted network of approved partners and AML/sanctions frameworks.

Visa Direct’s Casino & Gaming Use Case

One example of a gaming company that makes use of the full powers of Visa Direct is The Rank Group that manages the Grosvenor Casino and Mecca Bingo. One of their customers’ most significant friction points was the inability to collect winnings or withdraw funds in full, as the cash-out process took days. The long payment processing resulted in a high number of customers that cancelled withdrawal requests simply to avoid the need to make a deposit from their cards. By enabling Visa Direct services, the group dramatically improved the process for their customers, and 75% of them opted for this payment method. At the same time, The Rank Group reduced operational overhead by having fewer contact centre requests and more automated payments.

Similarly, Paddy Power Betfair, the international sports betting and gaming operator, had been experiencing lengthy withdrawals where customers could be waiting up to five days for the money to deposit. With the majority of their customers being Visa cardholders, the transition to a push-to-card payment solution was natural. It resulted in an increase in the weekly bets percentage and a noticeable increase in customer deposit values (14%) in just six months after implementation.

Visa Direct and the threats of the future

From March 2022, Visa expanded Visa Direct with the Visa Direct Payouts solution – this enables Visa’s global customers and partners to use a single connection point for real-time payments to eligible cards for domestic payments and to eligible cards and/or accounts for international payments. They believe that this new solution will move the disbursement market forward and embrace the power of an instant payments future.

Learn more about Visa Direct and find out how we can grow your business by visiting our dedicated page.