Unified payment systems and payments data are some of the most underutilised tools for small businesses everywhere. A unified payments solution combines two essential components of selling: a payment gateway and a merchant acquirer.

Many merchants choose to purchase these services from different payment service providers. However, there are lots of good reasons why you should use the same provider for both, including consistent access to consumer behaviour. We’ll dive into the importance of payment data next and how you can use it to grow your business significantly.

Optimising performance based on payments feedback

The average documented online shopping cart abandonment rate is 69.82%. Among the reasons contributing to a bad checkout experience, 9% are due to a lack of diversity of payment methods, 18% to a lack of trust in the security of the payment method, 16% to additional unforeseen costs, and 4% are due to card declines.

Using a unified payment system that can offer you payment insights into your customer’s behaviour online and in-store will help you easily shift your business strategy to accommodate your customers’ needs.

For example, keeping track of sales and chargeback volumes will give you insights into your website’s security and friendly fraud statistics so you can adjust your approach accordingly.

Similarly, keeping track of your transaction volume and average transaction value will help you optimise your marketing and upselling tactics so you can further engage new and existing customers. By combining improved and personalised offers, geolocation services, and consistency across channels, the entire payment experience becomes seamless.

Real-time insights into customer needs and trends

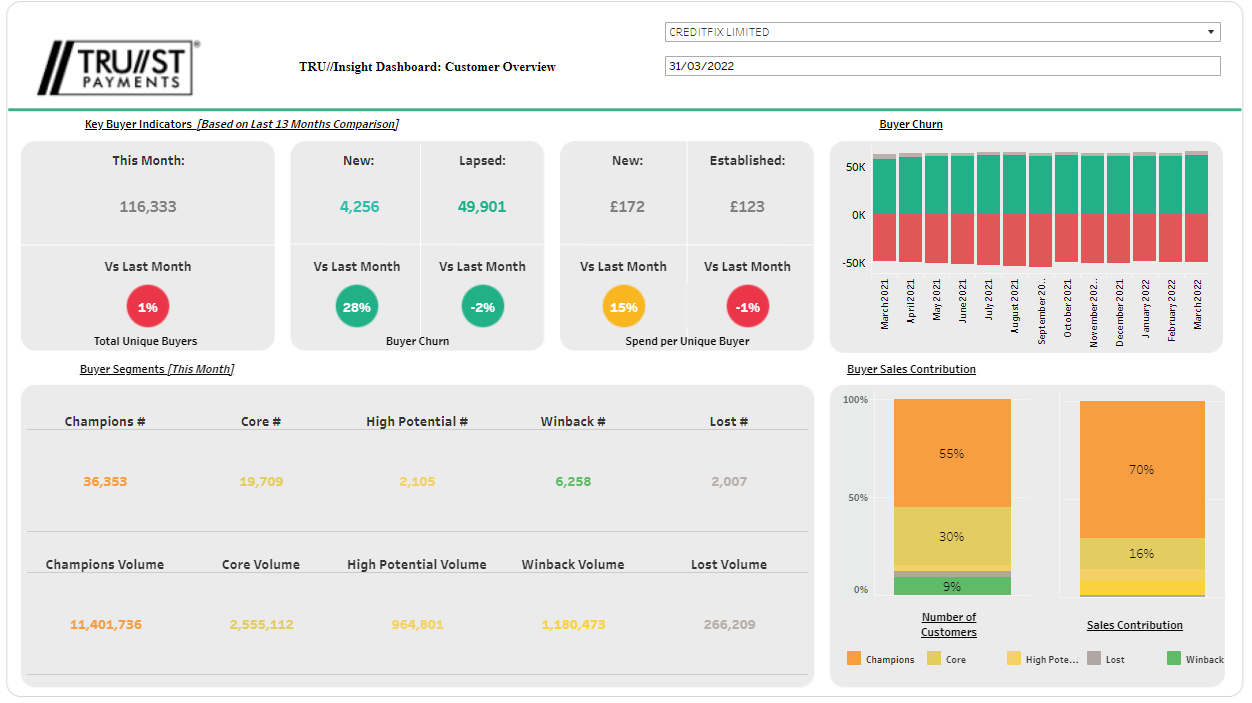

A customer’s payment data represents a behaviour indicator and is a key part of their profile. To determine which works best for your segments of customers, you need to investigate their behaviour, understand their needs, and test what works best for them.

You can identify your valuable customers by analysing average transaction amounts online or in-store or by tracking online and in-store behaviours that lead to loyalty. By customising your strategy to engage these customers more and nurture prospects into long-term customers, you will increase your chances of retaining them.

Conversion rates are another good indicator of customer behaviour. If there are multiple website users who enter your payment page and fail to complete their transaction, it shows potential issues with your checkout page. Furthermore, you can optimise how payment methods are displayed at checkout based on insights from the most common payment methods used by customers.

Easily plan cashflow

With payment insights like buyer churn, average fraud volumes, sales distribution by geography, spend per buyer, and buyer segments, you can predict and monitor cash flow.

Using these indicators, you can determine which geographic areas are more likely to experience fraudulent transactions and where your company earns the most revenue. With this method, you can chart the liquidity of your business by season without jeopardising cash flow.

Businesses can also gain insight into the total payments they can expect from their customers over the course of their Customer Lifetime Value (CLV) using payments data.

Using the right tool for buyer behaviour insights

Capitalising on payment data may be very lucrative if businesses learn how to leverage it. The right partner can help you make the most of this data and make the insights readily available to you.

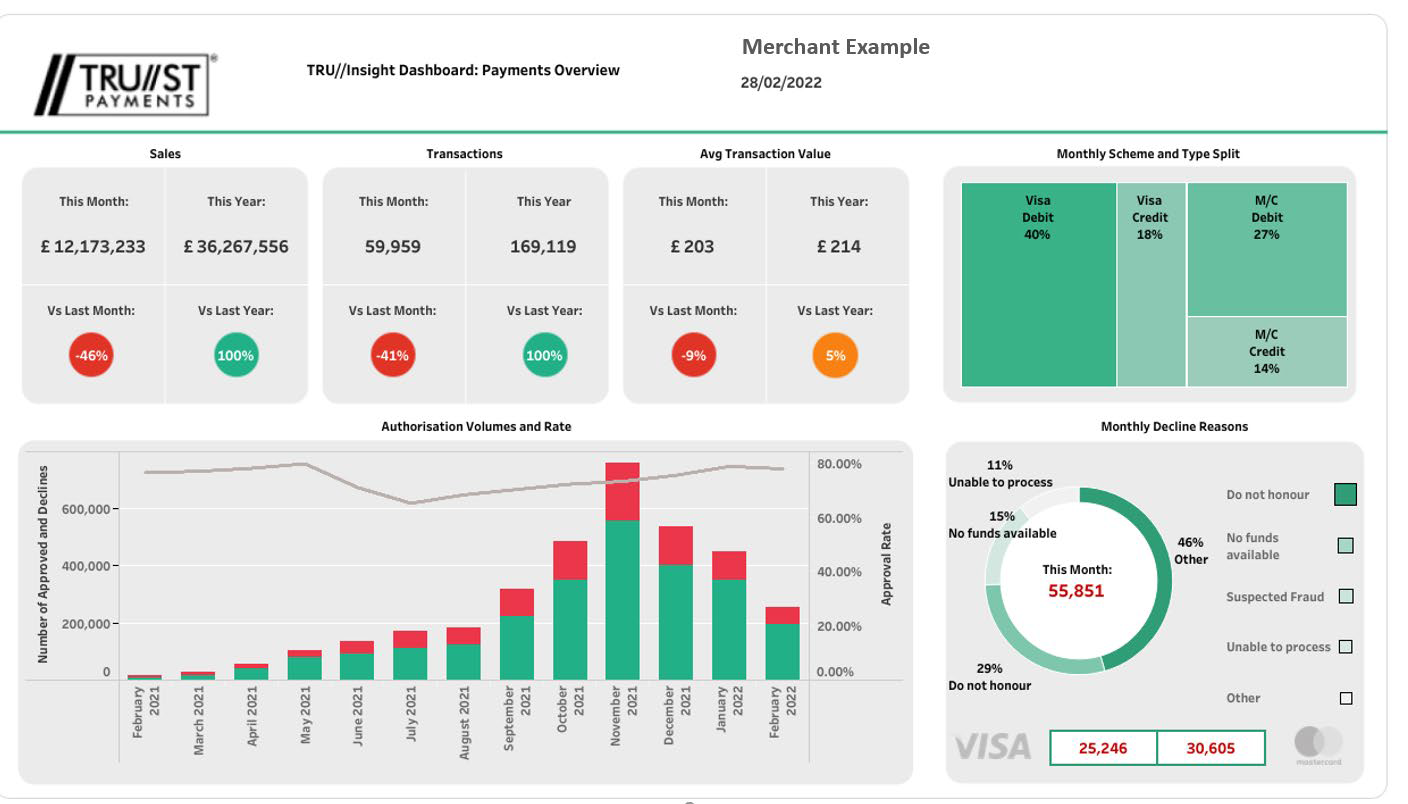

TRU Insight is a new service from Trust Payments that offers an analytics dashboard for merchants to get visibility over transactional trends and customers’ behaviours.

TRU Insights Dashboard Overview

The following transactional KPIs are measured and packaged in a series of monthly quick-to-view PDF reports:

- Sales Volume

- Transaction Volume

- Average Transaction Volume

- Decline Reasons

- Chargeback Volume

- Value of Fraud

- Average Fraud

- Buyer Churn

- Spend per unique buyer

- Geographic Customer Distribution

These reports allow businesses to measure and track performance from a payment perspective and understand customers’ payment behaviour changes over time so that they can make informed business decisions. And as data is delivered in a usable format, it eliminates the need to analyse large data sets or learn how to convert data into meaningful insights.

Start gathering payment insights today with TRU Insight. Contact us to get access to all our payment data solutions.