With a fifth of students enrolled in higher education in the UK coming from abroad, British universities and colleges have a duty to adapt their administrative and operational systems to cater for a global customer base, or risk alienating a significant proportion of their student body.

But what exactly does this mean? In a payments sense, it means creating a payments ecosystem that is fast, secure, and simple-to-use for all students, no matter where in the world they are from.

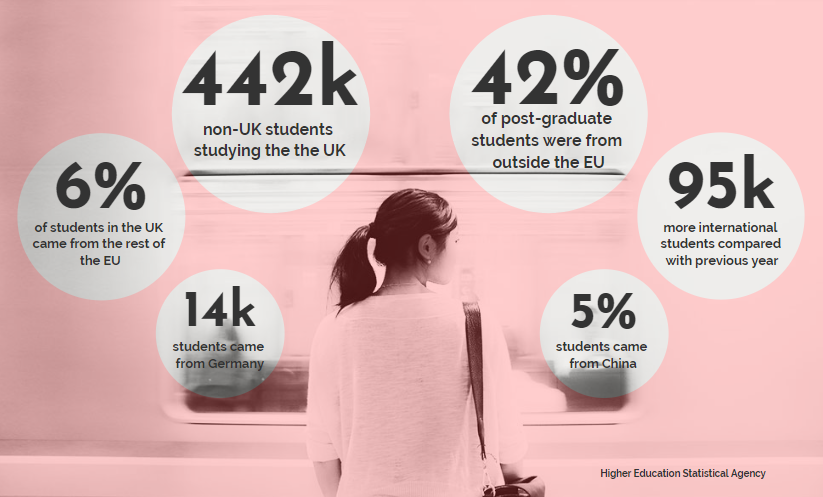

Here’s a breakdown of where UK-based students were from in the academic year 2016/17 to illustrate the importance of adapting your systems for an international student body:

Adapting your educational institution for international students is hugely beneficial on a number of levels. Financially, you can drive revenue by appealing to more customers; academically, you become a more viable educational option for the best young minds in the world; reputationally, you create an environment which is friendly and open to all.

Large fees are part and parcel of the university experience, whether this is paying for teaching or for accommodation. Universities and student housing companies can make sure that the payment process does not become a headache for students by employing a system that is completely straightforward, meaning that you can receive your fees in full and on time.

Essential tools for making your payments ecosystem as simple and clear as possible include:

- Dynamic Currency Conversion, which instantly converts costs into the customer’s home currency for greater transparency.

- Local payment methods, including e-wallets and bank transfer methods, which give customers the choice to pay using their preferred and the most convenient way.

- Multi-language payment pages, ensuring that the customer has clarity on every step of the transaction.

Trust Payments have powered the payments of a number of top educational institutions for a number of years.

With payment gateway solutions, as well as acquiring services through merchant acquiring arm acquiring.com, Trust Payments have the tools to help students, whether British or international, to make payments with minimal stress and confusion.

Trust Payments offer a number of essential local payment methods which facilitate fast and straightforward payments for students around the world. Examples of these methods are Alipay, an e-wallet used by 600 million people in China; Multibanco, a bank transfer method from Portugal; and SEPA Direct Debit, a one-off and continuous payment method applicable across the Eurozone.

Since 2015, acquiring.com have been the chosen merchant acquiring services provider for the London School of Economics, helping the university to receive payments for over 10,000 UK and international students and sponsors, and more than 500 commercial customers.

With such a high volume of transactions being processed through educational institutions, Trust Payment’s unique, state-of-the-art reporting portal MyST allows universities and independent student housing companies to track transactions and create intelligent reports to make the very most of Trust Payment’s payments expertise.

Trust Payment’s Head of Sales Craig Brightly, alongside TCAS Online’s Founder & CEO Barry Murphy, will be hosting a webinar on Tuesday January 29th to discuss how Trust Payment’s payment solutions can help universities and independent student accommodation providers to offer a fast, simple and localised fee payment experience for international students. The webinar will focus on the UK’s largest international student market – China.