COVID-19 has impacted everyone’s lives and fuelled significant changes to our spending habits. The online payments industry is now at the furthest that it’s ever been – cash is slowly being squeezed out of the mix. Consumers can now conveniently pay with contactless cards, mobile phones, and eWallets – this brought significant change to the payments ecosystem.

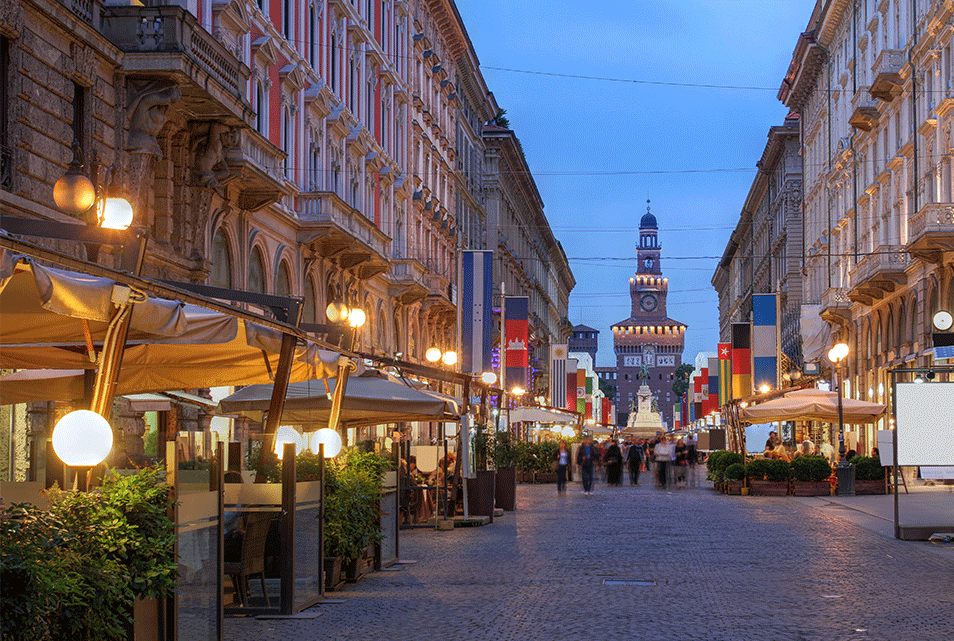

During the pandemic, Italy has been one of the countries that slowed down due to its struggling economy and high unemployment rates. Being one of Europe’s more modest online payments markets, Italy’s online shopping accounts for only 6.5% of overall retail, according to J.P. Morgan. Despite this, the Italian business-to-consumer eCommerce market has grown significantly since 2017, now worth EUR 31.6 billion.

The COVID-19 pandemic hit the nation particularly hard, driving Italians to shop online in unprecedented numbers. Necessity also sparked innovation, with Italians now accessing more sophisticated online commerce methods such as subscription models.

The impact of the crisis has not been consistent across sectors – travel and entertainment, which had been among the most advanced online purchase sectors, was hit particularly hard and faced an uncertain path to recovery. As Italy’s travel sector is moving slowly towards recovery, it’s essential to understand how consumer behaviour changed last year.

Preferred consumer payment methods

During the pandemic, high levels of fraud in all sectors led to a historical preference for prepaid cards and cash on delivery. Looking ahead, cash is set to decline while cards remain the primary payment method. By using secure online payments gateways, merchants can reassure customers of high anti-fraud protection measures at every browsing and payment process stage.

Mobile commerce now accounts for 40% of overall online payments, and its uptake is also rising across age groups. However, 98% of mobile payments are still adopted by 18 to 34-year olds, so this is a crucial demographic to target.

Consumers have also started to adopt digital wallet payments, which are predicted to grow to a third (32.2 %) of the overall payments market in Italy. PayPal™ is the most popular brand, taking a 25% share of the alternative payment market.

As a result of the shift towards online payments, businesses in the Italian travel industry should take note of the five key consumer purchase trends:

1. Social media commerce – time spent on Facebook’s suite of apps rose to 70% in March 2020. This has driven the social commerce uptake to go up as customers acclimatise to using these platforms to access online shopping, entertainment, and communication.

2. Spend cutbacks – according to YouGov, in 2021, 83% of polled consumers in Italy advised they intend to cut back on non-essential spending. Worries about health issues potentially affecting their finances are at the core of this behaviour.

3. Excess savings – Deloitte says that for the Eurozone, disposable income fell by around 3% in 2020. Italy was amongst the countries heavily affected, together with Spain and the United Kingdom. Still, consumer savings in Italy accounted for 19% of disposable income in 2020.

4. Increased chargeback levels – high online and card fraud levels have pushed customers to make unprecedented chargeback claims. With increased online traffic and reduced capacity to handle online transaction volumes, businesses in all sectors are experiencing a more significant impact due to chargebacks.

How to win consumer’s hearts this year

Italy recorded a decrease of approximately 67 million tourist arrivals in 2020, according to Statista. With vaccinations accelerating and consumers starting to dip into savings, how can the travel industry change course in the second half of 2021?

Here are our three main tips to ensure your travel business makes the best of the second half of 2021:

#1 Adapt offers to ever-changing customer preferences

Traveller preferences and behaviours have shifted towards the familiar and predictable. Domestic and regional vacations and the outdoors will prevail in the short-term forecasts. For international holidays in the near future, it’s good to keep customers stimulated by tweaking your business model. Offer customers full transparency on booking terms and be flexible. By offering a buy now pay later subscription model, you can ensure considerable customer retention.

#2 Enable smooth and safe payments

Considering the Italian customers’ health concerns, it’s important to respect social distancing rules in your physical branches. Health and safety concerns will continue to guide consumer behaviour in the short term. Travel businesses should enable a smooth payment process for customers: contactless payments on POS machines, digital wallet payments or mobile payments being preferred. Consumers expect contactless technologies, including biometrics, as a fundamental prerequisite for a safe and seamless travel experience.

Cybersecurity is also paramount as remote work becomes the norm in the short term and identities are digitised. Make sure your business takes every precaution to ensure that your customer’s online security is protected.

You can start working with an online payment gateway like Trust Payments that uses AI, machine learning and authentication technology to stop fraud in its track.

#3 Facilitate two-way communication with your customers

Travel operators and agents should ensure readiness and implementation of health protocols by third parties, such as hotels and airlines, in line with WTTC’s (The World Travel & Tourism Council) Safe Travel protocols. Extensive communications and the flow of accurate information between customers and suppliers will be a leading engine in the sector’s recovery.