- Products

Sell-on-the-move

Ingenico Move 5000

Take payments your customer's way

Sell-on-the-move

Ingenico Move 5000

Take payments your customer's way

Sell-on-the-move

Ingenico Move 5000

Take payments your customer's way

- Industries

- Case studies

- About us

- Content hub

Dynamic Currency Conversion

Improve your customer journey by giving your customers the option to pay in their local currency. We know how much people love this option, and we now offer it for both online and in-store (POS) solutions.

Why DCC?

New revenue stream

Maximise your earning capabilities by generating a new source of revenue for your business from existing international Point of Sale transactions.

Generate repeat business

Increase the opportunity for new and repeat business in the long term by offering greater customer choice and transparency.

Zero FX risk

With Dynamic Currency Conversion, there is no foreign exchange risk for your business or your customers as this is fully managed and absorbed.

What is DCC?

Our Dynamic Currency Conversion (DCC) feature on our POS terminal provides foreign cardholders with the choice to pay in their home currency at the point of sale. The retailer can take a commission on each transaction. For example – a visitor from the UK makes a purchase. The terminal will recognise where their card is from and offer for them to complete the sale in pound sterling.

How it works

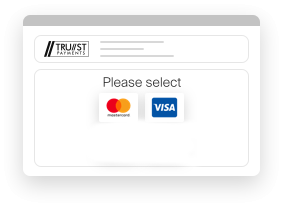

1. Payment choice

The customer chooses the payment type.

2. Card details are checked

The customer enters their payment details, and their local currency is determined from their BIN number.

3. Currency choice

The customer is displayed the amount in the merchant’s currency and their local currency. They choose the currency they prefer for the payment.

4. Authorisation

Customer benefits

- Customer Choice to pay in the currency they prefer

- Transparency on exchange rate

- Visa & Mastercard compliant

- Easy to use and convenient

- Rate is guaranteed

- Improved customer experience

FAQ

DCC is available on Visa and Mastercard (incl International Maestro).

The amount quoted at the time of the sale is the final amount the cardholder will be charged for in their home currency. Trust Payments DCC service comes with an exchange rate guarentee.

-The cardholder knows exactly the amount they will pay at point of sale.

-Competitive exchange rate provided by Reuters.

-Full transparency at the point of purchase.

-Exchange rate guarantee.

Ultimately the choice is down to the customer and it is essential they make the choice. If they choose to pay in their home currency, they will benefit from full visibility of the cost of the purchase in their home currency using today’s exchange rate.

No, this margin replaces the foreign exchange fee charged by the card issuer, and Visa or Mastercard when your card is used internationally.

The transaction can be completely reversed/refunded – in the currency of the original sale. If necessary, it can be recharged in the currency of the merchant.

Get started today

Learn more about Trust Payments by speaking to one of our expert consultants. Complete this form and we'll be in touch.