For the launch of Trust Payments brand new, cloud-based card-present solution, we caught up with Mark Keohane, Trust Payments point-of-sale expert, for an insight into his thoughts on where the POS market is today, and what the future of card and mobile wallet terminals has in store.

What is your background in POS?

After a previous career in the Royal Navy and with the British Royal Family, I started as an EPOS field engineer in 1991 with British tech giant ICL (which became Fujitsu). During the following 20 years, I worked with medium and large enterprise companies across the UK, Europe, US, Canada, Australia and Japan including Tesco, Apple, Hennes & Mauritz and Fast Retailing. The last 6 years of my time with Fujitsu I specialised on the new introduction of Chip & PIN in the UK from 2004. Since then I have developed and released fixed and mobile payment solutions along with supporting eco-systems with companies including Casio Electronics and Panasonic.

What are the most important features that merchants should look for in a POS machine in 2019?

POS and payments is now very much a commodity, a utility almost, where merchants are looking for a reliable card machine that comes with a dependable service at the best price. However, there are some new innovations in the world of payments which will allow merchants to serve their customers better, provide more than just card payments and offer a single point of reconciliation and reporting. Trust Payments are about to actively promote these solutions to our customers as part of our omni-channel payments offer.

How do you see the future of POS developing in the next few years? Are there any major technological events on the horizon that you think will disrupt how consumers make face-to-face payments?

It’s very easy to get carried away with the hype generated by the tech giants who often talk about ‘a revolution in payments’. The fact is in the medium term, cards are not going anywhere, and digital wallets will continue to proliferate, but they have to offer a compelling value for the consumer to use them – regularly. We are all seeing increased security now when we make payments both on-line and face-to-face, these will continue to prevail in the battle against payment fraud. Our old friend ‘cash’ is not going anywhere either. Card usage is gradually increasing at the expense of cash, but I don’t see merchants needing to retire their cash drawers just yet. Cash has continued to decline both as a share of retail transactions (falling 0.5 percent) and a share of retail sales (falling 1.2 percent). The British Retail Consortium believes that the cash decline is partly driven by more consumers using their cards for lower-value payments. UK Finance estimated that 3.4 million people hardly used cash at all during 2017.

How will Trust Payments POS solution benefit merchants?

Trust Payments are well advanced in our product and programme journey to bring innovative payment solutions to market, that deliver a rewarding experience for merchants and consumers alike. Hoteliers are focusing more and more on ‘the guest experience’, and restaurants and cafés want to maximise spend per diner whilst reducing table dwell time where possible. Retailers want to remove any barriers to footfall conversion, and business staff costs are increasing all the time with the minimum wage, workplace legislation requirements and staff training for existing and new staff. Secure Trading are promoting state-of-the-art hardware, software and services that go beyond the basic card payment experience, and provide merchants and their staff with solutions that help to meet customer expectations, in an increasingly tough environment for bricks & mortar businesses.

What advice would you give to a merchant that is thinking of taking on a new card machine provider?

If the merchant is only looking for a new payment machine/provider, or wants to add Trust Payments POS solution to our existing e-Commerce services, then we will be delighted to provide this. However, we have the knowledge and expertise to enlarge the discussion with the merchant as appropriate, in order to understand their business and transaction profile, and their current or future ‘customers’ journey’. We are engaging with businesses in a wide variety of sectors looking to increase choice, experience and value in their consumer transactions and the technology available today can now support this wider discussion, including:

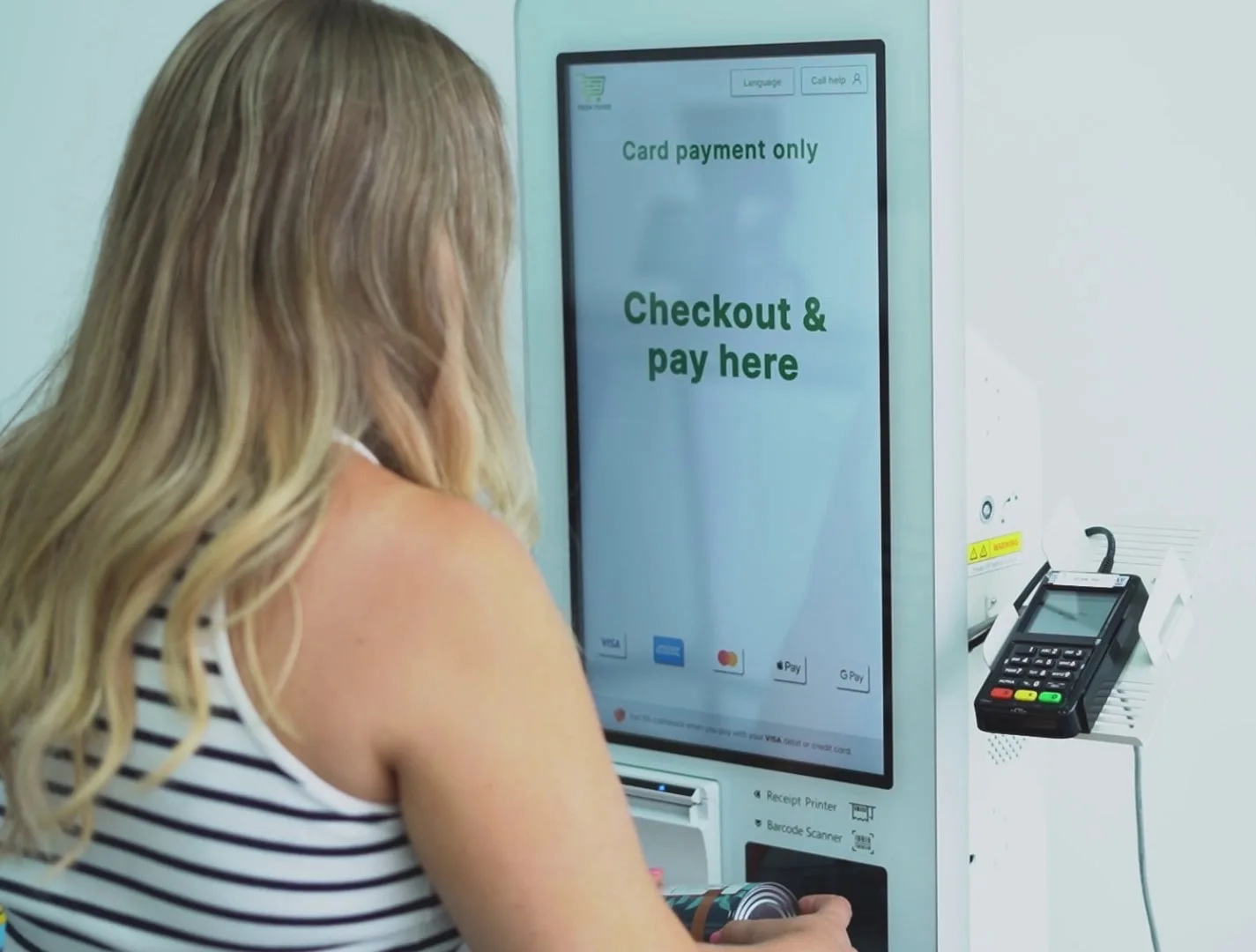

- More powerful payment terminals with large touchscreens allowing the wider provision of consumer services at the point-of-sale.

- Android-based combined payment terminals running EPOS apps are becoming widely used by merchants and accepted by cardholders as a method of payment.

- Smartphones being used as PIN-entry devices when connected to a basic card reader are also being adopted for small and independent businesses to help lower the cost of taking payments by card.

- Unattended payment solutions that can be deployed in self-service environments to support repeat, automated transactions whilst optimising customer service staff efficiency.

Smartphone and Smartwatch payments are still very fractional compared to plastic cards today, but new ways to pay are often driven by and dependent on consumer adoption, so whilst Trust Payments have an exciting payments roadmap over the coming years, we need to ensure that we bring compelling solutions to market that merchants and consumers want to use as part of their daily activities. The massive increase in contactless transactions in the UK is an excellent, compelling example of how speed and convenience for both merchants and cardholders have been instrumental in this, driving significantly increasing mass adoption.

To find out more about Trust Payments suite of omnichannel payment solutions, including point-of-sale, e-commerce, phone and email payments, speak to one of our team of experts today.